how much taxes deducted from paycheck nc suburban

Use this tool to. North Carolina payroll taxes are as easy as a walk along the outer banks.

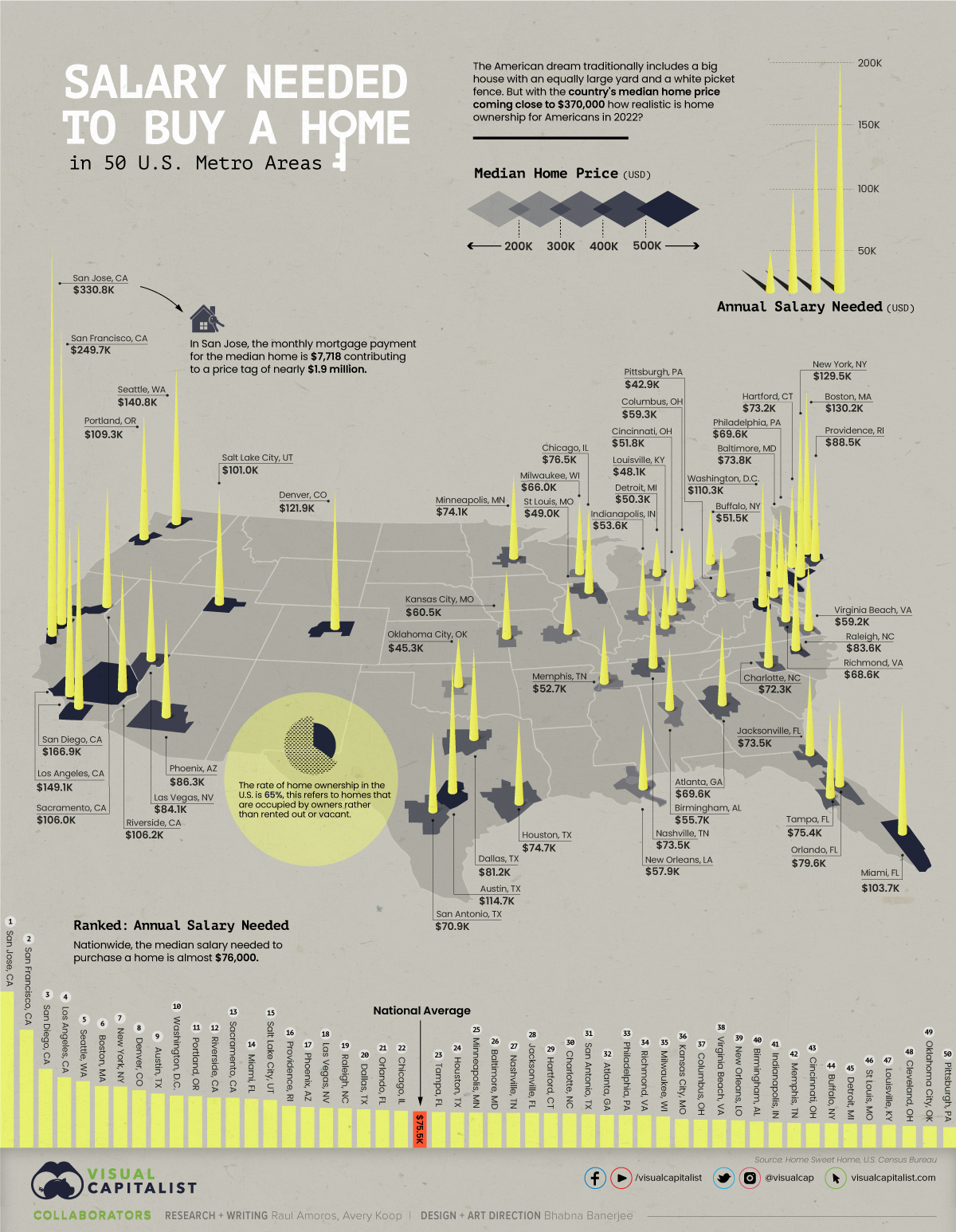

Mapped The Salary You Need To Buy A Home In 50 U S Cities

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

. North Carolina tax year starts from July 01 the year. We have designed this free tool to let you compare your paycheck withholding between 2 dates. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly.

It is a flat rate that is unchanged. For North Carolina tax purposes a taxpayer is allowed a deduction for the repayment to the extent the repayment is not deducted in arriving at the taxpayers adjusted gross income in the current. Your employee should provide you with an Employees Withholding Allowance Certificate.

10 on the first 9700 970 12 on the next 29774 357288 22 on the. Estimate your federal income tax withholding. Therefore it will deduct only the state income tax from your paycheck.

The IRS has changed the. If youre single and you make 50000 after subtracting deductions exemptions etc you would pay. The North Carolina tax.

Deductions for the employers benefit are limited as follows. In North Carolina The state income tax in North Carolina is 525. A in non-overtime workweeks wages may be reduced to the minimum wage level but cannot go below the minimum wage.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Fast easy accurate payroll and tax so you can. It is a flat rate that is unchanged.

For Tax Years 2017 and 2018 the North Carolina individual income tax rate is. See how your refund take-home pay or tax due are affected by withholding amount. What is North Carolinas State Income Tax.

This North Carolina hourly paycheck. No state-level payroll tax. For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525.

In North Carolina The state income tax in North Carolina is 525. This free easy to use payroll calculator will calculate your take home pay. For 2022 its a flat 499.

There is a flat income tax rate of 499 which means no matter who you are or how much you make. Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee. The amount of taxes to be.

Payroll taxes change all of the time. The income tax is a flat rate of 499. How It Works.

Therefore it will deduct only the state income tax from your paycheck. Supports hourly salary income and multiple pay frequencies.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Best 2011 Chevrolet Suburban Deals In November 2022 Cargurus

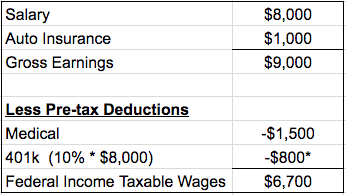

How Are Payroll Taxes Calculated Federal Income Taxable Wages Zenefits

North Carolina Hourly Paycheck Calculator Gusto

Take Home Paycheck Calculator Hourly Salary After Taxes

New Tax Law Take Home Pay Calculator For 75 000 Salary

North Carolina Hourly Paycheck Calculator Gusto

Your Paycheck Tax Withholdings And Payroll Deductions Explained

Free Online Paycheck Calculator Calculate Take Home Pay 2022

The Shrinking Tax Gap Between Philadelphia And Its Suburbs The Pew Charitable Trusts

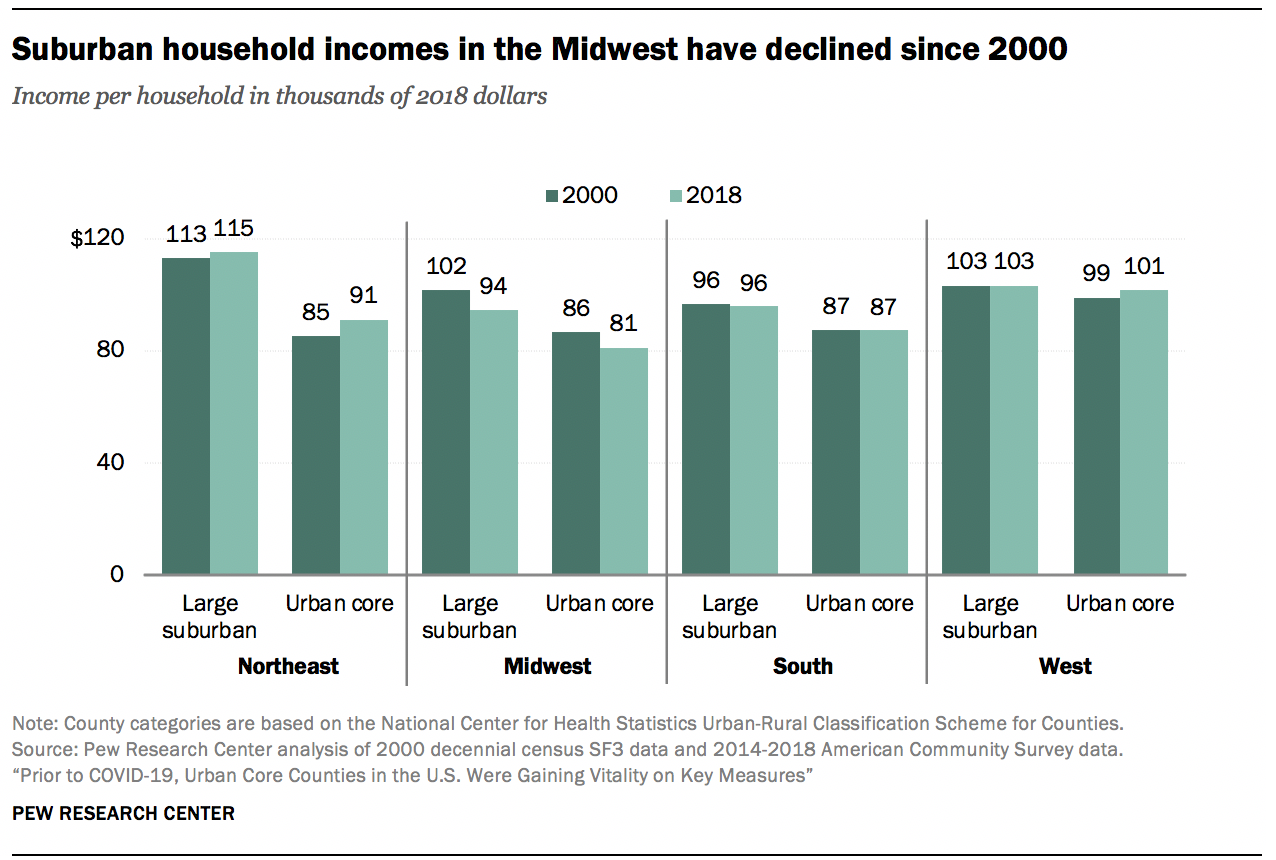

Comparing Urban Core Suburban Counties In The U S Pew Research Center

Property Taxes By County Interactive Map Tax Foundation

North Carolina Salary Calculator 2023 Icalculator

Minimum Wage Map Shows Which States You Can T Afford

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Urbanicity Realtor Com Economic Research

New Survey North Carolina Voters Want More Public Investments In Child Care The Pulse